Originally published on Noahpinion

It is vital for Georgists to understand the intersection of economic and political interests in the voting public. Many of the problems which Georgism has faced over the years stem from a fundamental misunderstanding of how to engage with the average voter, who is not motivated by ideological concerns or the desire to implement a perfectly efficient economic system, but is concerned about continued financial security for themself and their family. Accordingly, some class analysis is useful for identifying areas where Georgists can fruitfully engage voters’ interests, as well as the kinds of concerns and criticisms they should anticipate on the political stage. Noah Smith has been gracious enough to contribute his article on the matter for us to republish.

- The Editor

“Leave the apartment to buy alcohol/ Hung our diplomas on the bathroom wall/ Pick at the plaster chipped away/ Survey some stunning tooth decay/ Enlist the cat in the impending class war” — The Weakerthans

There’s an idea I’ve been toying around with, about the emergence of a new social class in America. Making up new class categories is always a bit of a dubious endeavor — there’s always an element of “Oh yeah, I know some people who are just like that”. Look, a guy in overalls on his way to a construction job…he must be a proletarian! Maybe he’ll join my workers’ revolution! Worth finding out, anyway. I mean OK, if you had multidimensional data, you could do a cluster analysis on all the various things that determine class in America (income, race, wealth, occupation, education, and so on) and correlate it with voting behavior or location choice or whatever and maybe extract some identifiable groups. And then no one would listen to you, because you’re just a boring statistics grad student, and definitely not in the class of people who, in the words of Douglas Adams, get invited to those kind of parties.

But anyway, I do think that spinning theories about new social classes can be an interesting and occasionally even fruitful activity. The best example of this that I know of is Barbara and John Ehrenreich’s 1977 essay “The Professional-Managerial Class”, in which they laid out a theory of a new class of Americans defined by their high-human-capital occupations. Although it wasn’t backed up by any statistical cluster analysis, the idea of the PMC was a useful addition to leftist discourse, because modern economies and especially the American economy had changed a lot since the days of Karl Marx. A new kind of capital — human capital — was becoming increasingly important to earning power, and the pursuit of human capital was reshaping lives, institutions, and social relations.

The PMC and the economic forces that spawned them are still around, of course, and in some ways more important than ever. But now I see another kind of economy emerging in America (and perhaps in other rich countries as well), which promises to reshape social relations again. It’s the homeownership economy.

Homeownership is an incredibly important source of wealth in the modern American economy. It generally makes up about 15-20% of U.S. household wealth:

Some economists argue that the entire increase in capital’s share of income over the past few decades is due to increases in the value of land. Other economists note that the rate of return on real estate, counting both price appreciation and rental yield, rivals that of stocks.

By now, the story of the homeowning class is well-known — how the U.S. decided to make housing, especially suburban housing, the engine of middle-class wealth, how policies like single-family zoning kept Black Americans from sharing in that wealth, how the shift to knowledge industries created a boom in demand for urban living that created a huge windfall for strategically located homeowners, how those homeowners dominate local politics and prevent the building of new rental housing supply to meet the new demand. The class of “homevoters” is by now well-discussed.

What’s less discussed are the classes of young people who don’t own homes. Some are poor or working-class, and are thus excluded from the economies of urban wealth and asset ownership. Among those are the class now being called the “precariat”, who lack steady employment and are forced to cobble together a living out of a web of tenuous work arrangements and social relationships. Others are successful high-earning PMC types, who might sigh at the price they have to pay for a home in a superstar city, but will eventually pony up the cash and become the next generation of bourgeoisie.

But in between those, I’m sensing there’s another class — people raised middle- or upper-middle class, but who for whatever reason have failed to get on either the income ladder of high-paying yuppie jobs or the wealth ladder of homeownership, and who are thus perpetually in danger of falling down out of the class into which they were born. I want to call these people the haut precariat.

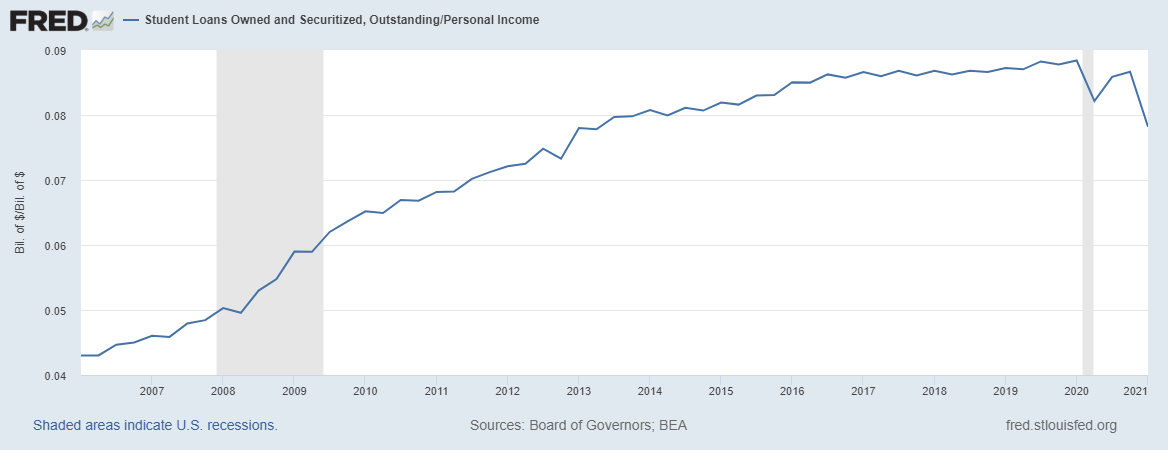

Several factors have come together, I think, to produce the haut precariat. First, there’s the student loan debacle. If social classes are defined by their assets, then liabilities surely matter too. You’ve all seen graphs that show the steady rise of student loans, but here’s one comparing it to personal income:

Now that’s fine for the high-powered yuppies at the top of the income distribution, but for the educated young people who fall off that ladder for even a little while, that debt creates an enormous burden. Boomers might have been able to take a few years off and hitchhike around the country selling weed and getting laid at hippie parties; if indebted Millennials and Zoomers try that, they’ll find themselves getting calls from collection agencies.

It’s tempting to moralize about this — to condemn the haut precariat as short-sighted slackers with inflated expectations who thought that because they were White (and they mostly are White) — they could get away with partying for years and still have high-paying jobs waiting for them on the other side. I would recommend that you resist this temptation. First of all, the student loan industry (now owned by the U.S. government) is predatory and 18-year-olds aren’t capable of making far-sighted financial decisions. Second, lots of the Boomers who went and slacked off really did come back and work hard and make up for lost time, perhaps with greater perspective as a result; people saddled with student loans don’t have that option. Forcing everyone to lever up in order to have a shot at a high-earning future anywhere down the line is basically a form of tracking — locking people into life paths way too early.

Also, the haut precariat have encountered quite a series of negative shocks over the course of their lives. There was the Great Recession, which permanently damaged the careers of a whole cohort of young people. At the same time, a number of high-powered career paths for non-STEM people — most importantly law, but also journalism, investment banking, and academia — have become a lot harder to break into of late. I wrote a thread back in 2018 conjecturing that the drying up of lucrative careers in non-technical fields was breeding a generation of angry leftists:

Others have been making similar hypotheses, and connecting this to the idea of “elite overproduction” — the idea that our higher education system, running on autopilot, has produced an excess of people with great expectations that they’ll end up as movers and shakers. The anger of the haut precariat might thus be contributing to our age of unrest.

And then there’s housing, and the move to the cities. Here’s where the story of the haut precariat intersects with that of the homevoting class. Young educated people want to move to the cities, because A) that’s where all the fun is, and B) if you’re going to get back on the yuppie escalator, you probably want to be where the good jobs are. But thanks to the homevoters and their supply restrictions, it’s hard for the haut precariat to afford a rental in San Francisco or NYC or Los Angeles — or, increasingly, in anywhere else they might find worth living. The haut precariat will tend to blame the yuppies for this, of course, but really it’s the homevoters.

Meanwhile, the haut precariat, almost by definition, don’t have enough cash or credit to buy a home in the expensive places they want to live in. So they’re shut out of the wealth escalator, and unless they know how to invest in stocks, they may end up wasting much of their savings by holding it in cash or just consuming it because they don’t know what else to do with it.

So this tends to lead us to a tidy little story where beleaguered young renters rage against the homevoters. This is the story that Alex Yablon tells in a post about the recent NYC mayoral race — young leftist renters versus old neoliberal rentiers. And yet at the end, he notices something perplexing — the leftist candidates aren’t the ones suggesting really meaningful increases in housing supply:

Following the lead of Minneapolis and Portland, the left should push for a citywide rezoning that eliminates local barriers to dense rental housing. Stringer and Wiley support rezoning some of the wealthiest neighborhoods in the city like SoHo, which is fine, but unlikely to fundamentally change the city’s political geography to the benefit of a tenant-powered left. Only a moderate, Kathryn Garcia, has embraced eliminating exclusionary single family residential zoning citywide. Though she deliberately distances herself from self-identified progressives, her plan to massively increase housing density provides the surest strategic route to the left’s long-term political success.

Yablon is left scratching his head as to why the NYC leftists are more NIMBY than the centrists.

In fact, the whole phenomenon of Left-NIMBYism throws a big wrench into the simple story of the haut precariat. It’s in the interests of precarious, educated, downwardly mobile renters to fight for policies that make rental housing as cheap as possible. And yet although there is a growing contingent of Left-YIMBYs, you still see a whole lot of young leftist activists around the country fighting against new housing projects. Online, the rhetoric of Left-NIMBYs sounds awfully like the rhetoric of the haut precariat’s well-to-do White suburban parents, endorsing things like local control and historic preservation:

The membership of the DSA, which has some more YIMBY branches but is NIMBY in a great many places, definitely fits the income, occupational, and demographic stereotype of the haut precariat.

So why are so many members of the haut precariat acting like the homevoters who should be their natural class enemies? It may simply be a case of ideology gone very wrong — people who really believe that building more housing somehow raises rents. But I wonder if there’s another factor as well — inheritance.

Houses have to go somewhere — if old people don’t sell their houses, they’ll leave them to their kids. And for members of the haut precariat, without real estate or stock portfolios or high-paying jobs of their own, their parents’ house in the ‘burbs might be the best shot at a nest egg that they have. If YIMBYism were to reduce the value of those houses, it would cut off their personal financial safety net.

Now, that’s just a conjecture; I don’t have evidence that this is why there are so many young Left-NIMBYs out there. But if it’s true, it suggests a rather depressing future evolution for much of the haut precariat — moving back to the suburbs and morphing into their homevoter parents. That would be a sad end to a generation screwed over by recession and student loans and the vicissitudes of the American economy.

Hopefully that will not come to pass. But whatever does come to pass, the haut precariat seem like an important social class in modern America, worthy of much more theorizing and study than I can deliver in this blog post. Maybe even some statistical analysis. If that isn’t too boring, of course.

Do either you or Noah have writing on the subject of declining fertility? 1) the subject of the economic/cultural effects of a generation of 2-kid vs. 3-kid families is underexplored 2) it directly bears on Noah’s speculative theory here: if you had 3 siblings (much less 6) that suburban nest egg house does much, much less for you financially and you have to seek financial salvation elsewhere.