Some Thoughts On Using Auctions For Land Valuation

Land value taxes are an attractive approach to public finance. However, some people argue that the difficulty of assessing land values makes land value taxation impractical. While I think assessment by governmental officials typically gis good enough for practical purposes, it’s worth thinking about ways to do even better. I believe a promising avenue for this is auctions so I’d like to stimulate Hdiscussion on using them.1 Thisbe article will accomplish that by outlining a specific land valuing auction system. These ideas are tentative, not certain, so I welcome critiques, comments, questions, and suggestions from readers to help refine them.

Auction Theory

Thinking about auctions all started when I wondered how we could solve the valuation problem to the exclusion of everything else. If we only cared about assessment, what could we do?

Well, we could require people to tear down their house before selling the land. More specifically, we could require that people remove all improvements such as buildings, fencing, and trees before putting their land on the market. That way, the price it sells for is determined solely by the value of the empty lot. Of course, this would be extremely inefficient. Destroying property each time a piece of land is sold would waste resources and increase transaction costs.

But I think the kernel of the idea can be salvaged. Rather than requiring that people actually sell an empty lot, why not require that they sell the land separately from the improvements? After working through the details, here’s what I propose:

Ownership of land may only be transferred if it is sold by a public auction. The winning bid is listed publicly.

Basically if you want to get rid of your land, you have to give everyone a chance to buy it. You are not allowed to transfer it over to a family member or sell it privately. By requiring a public auction, the selling price should approximate the true price of the land (more on that later). By listing winning bids publicly, people have a better sense of what to bid for plots nearby.

All improvements to the land such as houses, fencing, plants, etc. remain the property of the seller, who is free to keep possession or sell them as they wish.

So after the land is sold, the homeowner still “owns” the home. This part is necessary to ensure that people are bidding on the value of the empty lot and not pricing in the value of the home on top of it. After the land auction, the owner can just sell the house to the winner of the land auction (we’ll discuss this bargaining situation later). Alternatively, if the house is something like an RV that’s easy to move off the land, the owner might want to take it with them and leave the auction winner with an empty lot.

If the new owner of the land wants these improvements removed, they must be removed at the expense of the current owner of the improvements.

This part addresses any disagreements between the winner of the land auction and the homeowner. Usually, we would expect the homeowner to sell the home to the auction winner, but what happens if they can’t agree on a price? In that case, it’s the homeowners job to remove the house from the land at their own expense. Just like if I parked my car in your driveway and you want it gone, it’s my responsibility to drive it off the lot.

Land owners are taxed annually a small percentage of the amount they paid in auction for the land.

This is the land value tax we were promised. I imagine local jurisdictions would set the specific rate, but for concreteness let’s say it’s around 5%. This rate is related to how much rent a property of a given value can generate, otherwise known as the capitalization rate. For instance, if an empty plot of land generates 10% of its value in rent each year, then the tax rate should be around 10%.

Each year, the valuation and corresponding taxes are increased by a fixed percentage.

This rule is required to fix the holdout problem. Land values typically rise over time, meaning that the auction-based valuation for the land will quickly go out of date. Owners who hold land for a long time will have artificially low taxes, which incentivizes them to stay in one place. The problem is similar to California’s Prop 13, which limits the growth of property values and leads to owners holding their house. By raising the valuation each year, we can ensure that taxes keep up with the growth of land values. A growth rate around 5% seems like a good starting point.2 To be clear, we’re not adding this to the tax rate, but multiplying it, the taxes each year are:

Auction Valuation * (1.05)^t * 0.053

At any time, an owner can reset the land valuation by publicly auctioning their land and winning the auction.

There will be situations where the valuation growth from point 5 outpaces the true value of the house. The owner can update the land value by putting the land up for public auction, but they have to win that auction fair and square. If they win the auction, the land value is updated to their new bid, but no money changes hands (essentially, they pay themselves for the bid).

Okay, that was complicated; what does this new system buy us? For one, I’ll show that these auctions achieve reasonably-accurate valuations of the land without any need for land value assessors. That will be the focus of this post. Second, this system has the property that it compensates owners for improving the value of their land, while taxing subsequent owners as if those improvements are land.4 Third, people can upper-bound what taxes they will pay every year, there are no surprises due to changes in land assessment. Fourth, auctions are a fairer way to allocate land, preventing families from passing land wealth down the generations without updating their valuation. Fifth, the removal requirement creates a big market for modular and movable houses.

Of course, by providing accurate land values, we can get all the benefits of a land value tax such as efficient resource use, non-distortionary taxes, and detailed information about economic health.

But what I find most interesting about this proposal is how it clearly illustrates the policy tradeoffs when designing land value taxes. In the following sections, we will look at the factors affecting valuations, consider whether the post-auction home sale distorts valuations, saving the other details for a later post.

The accuracy of auction values

If the land auction is going to give us accurate land values, we need to be sure that the bids reflect the true value of the land.

Couldn’t buyers and sellers collude to lower the apparent auction prices for a piece of land in order to avoid taxes? For instance, they might agree to have the buyer pay $100K in auction for a $200K piece of land with the remaining $100K paid under-the-table. The problem with this plan is that other bidders can thwart them by offering a bid slightly higher than the artificially-low amount.

A related way to lower auction values and avoid taxes would be to negotiate the price of land improvements after the auction is complete. For instance, if an orchard has been planted on the land, this might normally raise the land value; but the current owner can promise to negotiate the price after the auction so that the orchard's value isn’t reflected in the bids, thus lowering the tax bill. As we’ll see in the next section, the seller bargains at a disadvantage for improvements that are costly to remove, so they have no incentive to make these sorts of promises.

But perhaps the seller could do the opposite, namely, promise to give the improvements away for free? At first glance it sounds foolish, but the guarantee that the improvements are free should raise bids, increasing the seller's profit. However, they aren’t incentivized to do this either! That’s because the bidders know they will be taxed on the size of their bid. The bids will increase, but they will increase by less than the market value of the improvements and the seller would take a loss.

The net effect is that the seller gets to decide what to include in the land auction. Some improvements are easy to remove, and the seller will prefer to keep them (or sell them on the open market). Some improvements are hard to remove, and the seller will prefer to leave them attached to the land and have their value reflected in higher bids. These auctions naturally distinguish between land and property, putting only the land-like improvements up for auction!

Another potential problem is that bidders have an incentive to undermine the value of the land, while owners have an incentive to inflate it. For instance, bidders could selectively publish information that makes a plot of land look less valuable. This is easier said than done given that nearby land values are listed publicly. For either party to manipulate the price, they would have to distort the valuation everywhere. Regardless, publishing information that would change a plot’s valuation doesn’t seem like such a bad thing.

One thing that will distort valuations upwards is the winner's curse. The person who wins an auction is likely to have the most distorted sense of its value. One would hope that they hew closely to local land prices, but over-bidding will happen. The use of a first-price auction will tend to lower bids, since in a first-price auction participants are incentivized to offer less than their true value.

Also note that the taxes themselves will tend to reduce the bids. If you’re expecting to get taxed based on your bid, it makes sense to lower your bid. This might look like a problem, but it's actually what land value taxes are designed to do. We want to drive the value of empty land close to zero, so that people are incentivized to actually use it rather than hold it. This isn’t really a distortion per se, since the land really is less valuable when it’s being taxed.

I believe a low land tax rate is justified since it is better to over-reward improvements to land than to over-penalize them. By ensuring that bidders make a profit if they win, it incentivizes them to participate and drive price discovery. To this end, it's better to err towards a system which underestimates land values.

So far, I’ve avoided talking about one big source of potential distortion: bargaining over the house itself. As we’ll see in the next section, this has a surprisingly small effect on bids.

Bargaining and price distortions

The post-auction sale of the home creates a unique bargaining situation. At first glance, it seems like the homeowner can charge the landowner a high price for the house, since if no deal is reached, the homeowner can tear down the house and force the landowner to build a new one from scratch. However, the homeowner would be saddled with the costs to tear down the house.

To figure out who has the upper hand, we need to carefully model the different costs and benefits to each party. In the appendix, I use a Nash bargaining model to estimate how much the home price gets distorted (note: this model doesn’t fit real world bargaining very well, so I would love to see other attempts to model this). The headline result is that the price should be:

P = V + (C_b - C_s)/2

Where:

P is the agreed-upon price

V is the true market value of the home

C_b is the cost to build a new house

C_s is the cost to remove the house from the property.

Let’s consider a worst-case scenario for the seller. Let’s assume that there is no way to remove the house without completely destroying its value, so C_s = V. Let’s also assume that the buyer can buy a new home with no markup, that is, buying a new home doesn’t change their wealth on net, so C_b = 0. Then we get:

P ~ 0.5*V

Oh no! The seller only gets half the market value for their house! The risk of having to tear it down puts them at a disadvantage and forces them to sell below market rate.

However, there’s two countervailing factors to consider:

A cheap house raises land bids. That is, since the bidders know they can get a good deal on the house after the auction, they’ll raise their bids. Though they won’t raise them by a full V/2 due to the taxes.

All buyers eventually become sellers. The winning bidder might enjoy a bargaining advantage when they purchase the house, but the tables are turned once they need to sell the house! This cancels out some of the buyer's original advantage.

In the appendix, I attempt to account for these factors and include other things like the cost to tear down a house, contracting costs, and the time delay cost of building a new home. In the end, the seller mostly recoups the value of their home and land values are distorted upwards by only 1.5%.

So we have a clear reason why the land valuation reflected in the bids will be distorted, does that kill the proposal? I don’t think it’s a fatal issue, since we can easily correct for the distortion when setting tax rates. For example, if we wanted to tax land at 5% but we expect this bargaining effect to raise bids by 10%, then we would simply lower the tax rate by the same amount and tax at 4.5%.

I also expect future technologies to lower the degree of distortion. After this law is in place, there will be a market for movable houses. With a movable house, C_s goes to zero and the sale price matches the market price.

Conclusion

After wrapping my head around land auctions, I think they can work well as a land-value assessment system. They let the market decide what the value of a piece of land is worth, without any need for state-run land value assessments. Doing away with the need for assessors is pretty valuable for land that isn’t administered by a state such as land in space. It's also valuable for places without the state-capacity to conduct fair land value assessments at scale.

That being said, it’s not clear to me that auctions are better than assessment in places like the United States where accurate and fair land value assessments are already the norm. Part of the argument comes down to how much error there is in land value assessment. Auctions have errors of roughly 2%, can assessment do better?

If I had to make the case that auctions are better than assessment, I would point to two advantages. One, the taxes are more predictable and transparent to owners, they know that taxes are a percent of their original bid that rises over time and can plan accordingly. With assessment, annual changes in the value of the land may come as a surprise. Two, auctions are more fair as everyone has the opportunity to buy a piece of land. I think this is more in line with the Georgist ideal of land being a commons that all citizens share.

In general, I hope this gets you thinking about auctions as a method to assess land values. Your feedback will help determine how I approach a sequel article I plan to write which will expand on these ideas and how they can be applied to other types of economic land.

Notes

Appendix 1: Nash bargaining model

Here, I estimate the amount an owner can raise the price of their home when selling to the person who has already bought the land.

In this case, we have a Seller who owns the house built on a piece of land, and a potential Buyer who has already bought the land itself in auction. The seller would like to sell their home for a reasonable price, but can also remove the home from the property and sell it elsewhere (or tear it down). The buyer would prefer to buy the home rather than build a new one on the land.

There are two possible outcomes of this negotiation:

Deal: The buyer pays the seller an agreed-upon price P for the house.

No Deal: The buyer refuses to pay for the house, and will have to pay to construct a new building on the property. The seller must remove the house from the land and can either keep the house for themselves or sell it to a third party.

To analyze the negotiation, let's assume that:

The market value of the house V is known to both parties

The seller pays cost C_s if they must remove the house from the land

The buyer pays cost C_b if they must of build a new house on the land

Both buyer and seller seek to maximize their wealth (that is, their utility function is linear in total wealth)

The buyer and seller agree on a price P using the Nash bargaining solution

The first assumption means that there is no information asymmetry between buyer and seller about the true value of the house. Though this is not realistic, information asymmetries for most commodities are small, and we rarely worry about the distortions this creates in other markets. Considering information asymmetry explicitly would be useful, but I ignore it here to simplify the analysis.

C_s can be thought of as the set of costs associated with physically removing the house from the land, searching for a new buyer, and the depreciation of home value when it is separated from a piece of land (including damage done during transport).

C_b can be thought of as the cost of constructing a new home which includes the cost of materials, labor, and the time spent waiting for a new home.

The Nash bargaining model provides a simple way to determine the result of the negotiations. Though it does not accurately predict the outcomes of real negotiations, it can give us a rough picture of the price distortions.

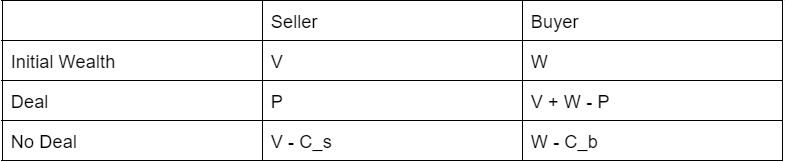

This table gives us each players wealth in different scenarios:

Let's turn to the resulting price under these circumstances. Under the Nash bargaining solution, the agents agree on a price P which maximizes:

F = (V + W - P - W + C_b)(P - V + C_s)

= (V + W - P - W + C_b)(P - V + C_s)

= PV - P^2 + PC_b - V^2 + VP - VC_b + VC_s - PC_s + C_s*C_b

We can find the value of P which maximizes this function by taking the derivative of F with respect to P, setting the result equal to zero, and solving for P:

dF/dP = V - 2P + C_b + V - C_s = 2V - 2P + C_b - C_s = 0

P = V + (C_b - C_s)/2

Intuitively, the distortion of P relative to V depends on C_b and C_s. If C_b is high, the seller has more bargaining power and can overcharge for the house. If C_s is high, the buyer has more bargaining power and can receive a lower price for the house.

The second term is essentially the amount of “loss” the buyer can expect in a deal, so their expected profit is:

(C_s - C_b)/2

Follow-on effects of the price distortion

So on this model, home prices will be distorted. But, there’s two key follow-on effects of this price distortion:

Increased land value bids. Since bidders know they can get away with buying the home cheaper than the true value, they will increase their bids. Without taxes, the bidders would increase their bids by almost the V/2 profit they can expect to make. However, they won’t increase their bids fully, since they will be taxed based on the higher bids. Notice that from the sellers perspective, they get roughly the true value of the house, it is just that part of the home value comes from the land bid while another part comes from the home sale. From the seller’s perspective, this looks like a small “tax” on the value of their home. From the buyers perspective, they will be taxed on the portion of the home price that they included in their land bid.

One way to approximate the total amount of additional taxes they will pay by:

Taxes = r*V*t

Where t is the number of years they stay in the house. A simple way to adjust bids based on these additional taxes would be to subtract the taxes from the original bid.

The future value of the house. The winning bidder might enjoy a bargaining advantage when they first buy the house, but the tables are turned when they need to sell their house! This cancels out some of the buyer's advantages in the first place. This partially cancels out the effect of taxes on land value bids. The loss they experience when they sell the house depends on how much it depreciates in value over time.

Let’s say the house has value V today and, as a result of bargaining, the bidder profits by an amount f*V (where f is some fraction of the full value). Let's also assume that the value depreciates over time at a rate d. Finally, let’s assume that the bidder stays in the house for t years. Their net profit, including both the profit when they buy the house and the loss when they sell it, is:

f*V - f*(V*d^t) = f*V*(1-d^t)

So this depreciation reduces the total profit by a certain factor.

The worst-case scenario

Let's consider a worst-case scenario where the new buyer of the house has all the power. For now, let’s ignore follow-on effects. Removing a home completely destroys the home value, so C_s = V. The buyer on the other hand, has the option of buying a new home immediately for no markup. The price they pay for the home is exactly equal to its value, such that it doesn’t reduce net wealth at all. C_b =0

Then:

P = V + (0 - V)/2 = V/2

In this case, the home is sold for half its true value.

The “market for movable houses scenario”

I also find it informative to consider a situation where this law has been in effect for a long time and efficient industries for home moving, selling, and building have developed (perhaps via a market in modular homes). In this world, it's easy to pluck a home off a lot and plant it somewhere else, so the seller has the option to sell their home on the market for its market value, and the buyer can buy a home for its market value. Here, C_s and C_b approach zero, and P approaches V.

P ~ V

This means that over the long term, new industries and innovations will reduce the resulting price distortion. Over the long term, homebuilding technology (such as modular houses) should lower the cost of building a new home, lowering V relative to the land value and reducing the effect on bids.

The realistic scenario

For a more realistic guess, let’s list the components of the formulas and estimate them.

For V:

The median property sale is a little over $400K. A typical rule of thumb is that land constitutes 70% of the property value. So:

V = 0.3*400K = 120K

For C_s we have:

The cost of physically removing a house (~$10K)

The reduction in the value of your home when you take it off the property. Unless your home is easily removable like an RV, removing the home destroys its value, so the loss is roughly V

Total: C_s = 120K + 10K

For C_b we have:

The time cost of waiting for a new home to be constructed which takes roughly 8 months. If we use median rents in the US of $2K then this amounts to $16K of lost rental income by delaying rent payments with a 5% discount rate.5 (0.05*⅔)*2K*12/0.05

The markup when building a new home. E.g. the difference between what you pay to build a new home and the actual value. This should roughly be reflected in the price to buy a new home versus an existing home, a difference of roughly $60K.6

Total: C_b = 76K

For the taxes, let's assume we tax land at a rate of 5%, a person stays in their home for 10 years, and that

For the depreciation, let’s assume someone stays in their home for 10 years7 and use the general depreciation system to set the depreciation rate at 3.636%.8

So the depreciation factor is:

1 - (1-0.03636)^10 = 0.31

Putting this all together:

P = 120K + ½[ 76K - (120K + 10K) ] = 93K

So after bargaining, the buyer will get a $120K house for only $93K. How will this change the original bid? The buyer stands to make a $27K profit which we can add to the original bid, but then we have to adjust for the higher taxes and depreciation factor:

Bid = L + (27K - 0.05*27K*10)*0.31 = L + 4K

Where L is the true value of the land, we can fill this in:

Bid = 280K + 4K = 284K

So in total, the property owner gets $377K for $400K worth of property, a 6% loss. This is equivalent to a one-time property tax of 6%. How distorted is the land bid? The bidder paid $284K when they should have paid $280K, less than a 1.5% distortion. Not bad!

How much revenue would this generate? With that land value, it would generate $14.2K per year. With 144 million homes in the U.S., that comes out to roughly $2 trillion, covering a large portion of the roughly $3 trillion of federal tax receipts each year.

Appendix 2: Other potential problems

Problem 1: Requiring separate sales for land and property raises overall transaction costs.

Counterpoint 1: While it does raise transaction costs by adding an auction to the process of homebuying, a frequent public auction also increases transparency and lowers search costs. It’s not clear which effect is stronger, but given that homebuying already has many transaction costs, this is unlikely to be a large effect.

Problem 2: This will increase the number of home teardowns overall when buyers and sellers can’t agree on a price for the house. Since the homeowner has to pay for teardown, it lowers the cost of teardown for the landowner. If the landowner was already planning to tear down the house, they can get the homeowner to do it for them.

Counterpoint 2: This raises the bids a corresponding amount, so it shouldn’t be a big issue. If a bidder knows they can get a teardown for free after the auction they will raise their bids by roughly that amount.

Problem 3: Auctions have costs. The risk of moving or being forced out of home has large costs.

Counterpoint 3: This is the inevitable tradeoff with allocative efficiency and occurs in any approach to land allocation. The tax growth rate can be set low to prevent this.

Problem 4: People wouldn’t want to participate in an auction that they know the owner is attempting to re-buy, since that owner will set a very high price.

Counterpoint 4: It shouldn’t be that difficult to submit a bid, and nearby land values give you a pretty good estimate of what the land is worth. Even in a re-buy auction, owners will likely face bids similar to local market prices and in some situations, other people will have very high values for the land, such as holdouts in a housing development.

Problem 5: One company could buy a competitor’s office building, forcing the whole office to move and hurting productivity.

Counterpoint 5: In the case of a successful bid, the company is paying their enemy a large sum of money and paying a lot of taxes for a building they don’t need. If this does become a problem, a keyhole solution is to treat this specific behavior as anti-competitive and assess each case in court.

And even beyond the practical advantages, I find that thinking about auctions generally grants a more “gears-level” understanding of land and property values.

Note: this growth rate can be tied to local market conditions, for instance, the growth rate could be based on data from the closest 10 sales in the last year. H/T to Stephen Hoskins for this suggestion

I plan to cover the details of setting this rate in a later article.

I also plan to cover this more in a subsequent article.

There's actually a lot of similarity between this auction-based valuation and assessment-based valuation. An assessment-based system is always disciplined to sales, which *are* auctions when the seller is trying to get the fair market value for their land. The difference is that an assessment system doesn't try as hard to get the most relevant information — it just accepts whatever sale data is available from the neighborhood, and interpolates across time and space. For a plot of land that hasn't been sold in a long time you have to look at nearby plots of land that have sold more recently to inform the valuation. But by encouraging regular auctions with the compounding increase in the tax, this interpolation is unnecessary, and the assessed value can simply be based on the most recent valuation for that exact plot of land. It's easier to understand (no complex assessment models), requires less labor (no model maintenance or dispute resolution), and handles edge cases perfectly (valuation is based on the exact plot of land and its unique location and features). Very compelling!

Sam, Thank you for this healthy mental exercise on a Thursday morning. I didn't follow the tax part: when do people start paying this land value tax? Only when the new owner takes possession of the land, at the price she bid? If no land is sold, how is it to be valued?

If you haven't seen it, take a look at 'Radical Markets' by Posner and Weyl who propose a similar land auction model, starting with a self assessment for tax purposes - with the proviso that anyone can buy your land once you have declared your value... set the value too low, and risk losing your home!

All the best

Andrew